Key Points

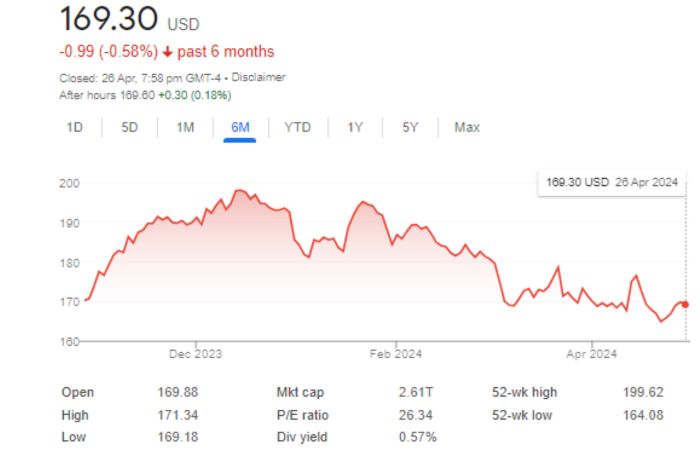

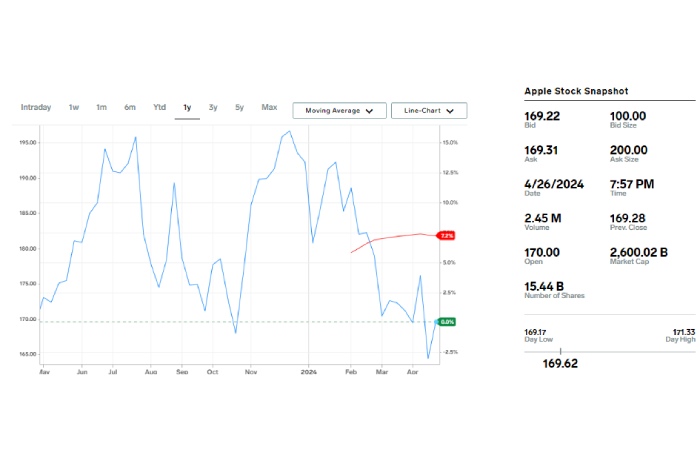

- As of April 2024, Fintechzoom Apple stock was trading from $169 to $170, with continued fluctuations compared to the previous year.

- Analysts estimate that Apple’s revenue growth will come primarily from its services in 2025, with total revenue reaching approximately $400 billion.

- FintechZoom provides in-depth analysis, market forecasts, and tools to help investors assess Apple stock fluctuation rates based on market conditions.

Live Apple Stock Results:

Apple Inc. (AAPL) is one of the most watched stocks on the NASDAQ. It is an indicator of the health of the technology industry and the overall market trends. Apple is known for launching innovative products like iPhones, iPads, and Mac computers, making it a great company. Its financial performance reflects its market supremacy and capabilities.

Investors and analysts around the world are closely monitoring the movements of AAPL stock. This article will give you a Fintechzoom insight into the performance of Apple stock to analyze its recent activities and the company’s future.

What Does Investing in Apple Stock Mean?

Investing in Apple stock means buying shares and owning a piece of the company. Stock prices fluctuate based on many factors, including product launches, three-monthly earnings reports, market trends, and general economic conditions. Similarly, Apple’s stock price has moved throughout the year based on industry news.

Apple’s rise in the stock market began after introducing ground-breaking products such as the iPod, iPhone, and iPad. These products revolutionized Apple’s respective markets and created new revenue streams, improving its stock performance.

The launch of the iPhone in 2007 and its subsequent types boosted Apple’s stock price due to its mass appeal and huge sales figures. This makes Apple stock an attractive option for high-net-worth investors who want to multiply their wealth by investing in these premium stocks.

So, if you are new to investing, should you consider investing in Apple stock?

How Does Apple Deal with Economic Downturns?

Indeed, Apple stock has successfully managed many economic fluctuations and competitive challenges. It managed to maintain its growth during general market unpredictability, such as the 2008 financial crisis and the recent global supply chain disruptions caused by the COVID-19 pandemic.

This reflected its strong operational fundamentals and strategic vision. While other companies were struggling, Apple continued to increase its product lines and enter new markets, such as streaming and financial services. This helped diversify its revenue streams and reduce its reliance on a single product line.

What Is Apple Stocks’ Current Performance in the Market?

The highest closing price of Apple (AAPL) in 2023 was $197.86 on December 14, 2023, which is an all-time high for the stock. Analysts have set a high forecast of $250 for 2024 as they anticipate a possible price increase from current trading levels. However, during the first quarter of 2024, Apple’s stock fluctuated significantly, with a downward slope in the stock price.

Apple also faces risks, such as competitive pressure, regulatory challenges, and economic crises. Apple recently lost its leadership position in smartphone shipments to Samsung, which has impacted its stock valuation in the short term.

Global supply chain issues and economic settings such as rise or interest rate changes can also impact Apple’s profitability and stock performance. However, future products like Mac computers enhanced with M4 chips should drive growth and investor interest.

What Is Fintechzoom Apple Stock?

Fintechzoom Apple Stock is a financial analytics platform that provides insights into stock performance. It provides real-time data, expert analysis, and market forecasts that help investors understand and respond to changing market conditions for Apple stock and where they might be headed.

Fintech Zoom helps shape investor perceptions through tools and analytics that track marketplace needs, analyze economic impacts on stock act, and predict future market behavior. Investors turn to this platform for insights into Apple stock performance.

Recent Updates About Fintechzoom Apple Stock

FintechZoom provides an in-depth analysis of Apple stock and considers it a solid investment with future growth potential. They highlight Apple’s consistent historical growth through strategic product launches and significant market resilience.

Despite the usual market volatility, Apple’s stock stands out for its stability, as evidenced by its strong balance sheet and devoted customer base. Fintechzoom Apple Stock provides us with Apple’s earnings reports and future projections to shape investor expectations.

They also discuss the possible impact of new product launches on stock value. This makes them a go-to resource for investors looking for insight into Apple’s financial health and market outlook.

How Is Apple Preparation to Sustain Its Growth?

Here are some of the key strategies that Apple is likely to implement to drive its future growth

Innovation in product lines

Apple is constantly investing in research and development to improve its core products and remain the market leader in the smartphone industry. By using the latest technologies, better processors, and advanced camera systems, Apple ensures its goods remain popular in consumer technology. We expect more advancements in the upcoming iPhone 16 in September 2024.

Expansion Into New Services

Apple has been expanding its services separation, which comprises Apple Music, Apple TV+, iCloud, and the App Store. The global expansion of these services and the introduction of new services are expected to drive future growth. By 2025, Apple is expected to make more money from its services than its products.

Venturing Into Health Technology

Apple has shown a growing interest in health technology done its Apple Watch and health apps. The company is expected to continue exploring this sector and possibly introduce new health-related products.

Investing In Artificial Intelligence

Apple is investing in artificial intelligence and appliance learning to improve its products and services. There could be more updates to Siri, predictive capabilities in its operating systems, and new AI-based features in its product lines. It is speculated that the upcoming iOS 18 will have AI features that will be fully installed on the device.

Developing Proprietary Technologies

Apple is known for creating and using its hardware components, such as the M-series chips custom-designed for the Mac. Developing its technology gives Apple a competitive advantage by differentiating its products from competitors and improving their performance. Apple’s next-generation M4 chip is expected to launch in the first quarter of 2025 and will be used in several future Apple products.

So, let’s see how all these innovations will impact Apple’s stock price.

Conclusion

FintechZoom Apple stock analysis will give investors a strategic advantage in understanding the technology market. As Apple expands its product lines, detailed analysis becomes vital in predicting future stock movements and potential investment returns.

Investors can make more informed decisions, take advantage of market opportunities, and potentially earn a better return on their investment in Apple stock. However, being wary of how competitors plan to behave against Apple stock is essential.

Frequently Asked Questions – FAQs

What role do Apple stock analysis tools play?

They perform various functions like real-time price monitoring, technical analysis, and market sentiment monitoring.

How are Apple stock price predictions made?

They are made by analyzing historical data and current trends.

Where can I see Apple stock news on fintechzoom?

Open the website and search for “Apple Stock News.” visit this section and check the news.